The timeline of purchasing a new home is a crucial aspect of the entire process. It dictates the steps you need to take, from initial research to final closing. Understanding this timeline ensures a smooth transaction and helps you avoid common pitfalls. This article will delve deep into the specifics, outlining the key stages and offering actionable tips for navigating each phase, guaranteeing you’re fully informed and ready for your new home. This comprehensive guide includes detailed breakdowns of each stage, real-world examples, and actionable insights to help you successfully navigate the journey. Get ready to transform your dream into reality!

Initial Steps: Research and Planning

Understanding Your Needs and Budget

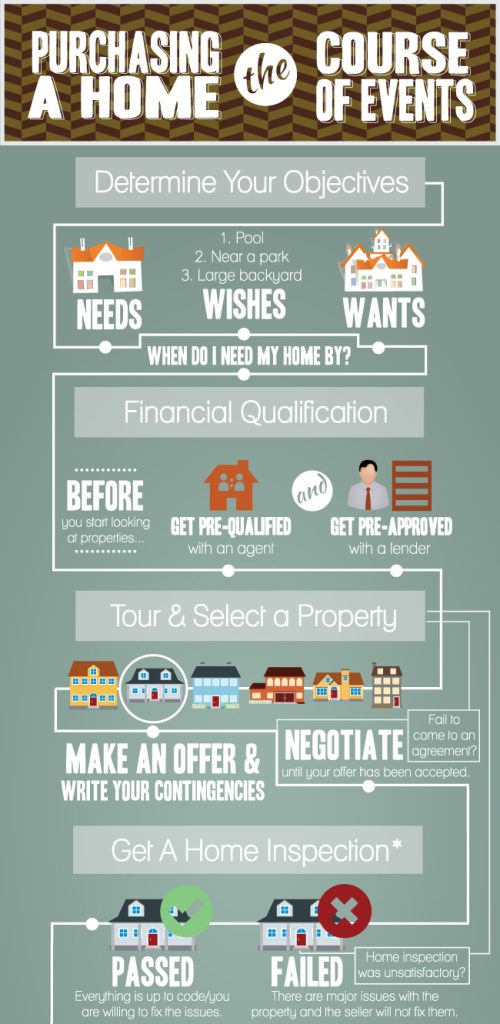

Identifying your financial capabilities and desired lifestyle is paramount before starting the search. A realistic budget that accounts for down payments, closing costs, and ongoing expenses is crucial. Consider factors such as the neighborhood you desire, the size of the home, and its features. Consider the monthly housing costs, including property taxes and homeowner’s insurance, when calculating your budget. A detailed budget will prevent you from overspending and ensure a smooth process. For example, if you’re aiming for a 3-bedroom house in a desirable area, research the average prices and factor in potential maintenance costs. Also, don’t forget about unexpected expenses that may pop up during the process.

Securing Pre-Approval for a Mortgage Loan

Obtaining a pre-approval from a lender is a critical first step. This shows sellers you are a serious buyer, as you will have established your purchasing power upfront. This will allow you to focus your search on properties within your budget. Getting a pre-approval gives you a clear understanding of your financing options and how much you can realistically afford. Lenders typically analyze your income, credit score, and debts to determine the loan amount and interest rate. This step will save you from disappointment later and accelerate your home buying process.

Selecting a Real Estate Agent

Choosing a qualified and experienced real estate agent is essential for a successful purchase. A good agent will guide you through the process, provide valuable market insights, and advocate on your behalf. Finding an agent aligns with your needs and priorities; make sure they are knowledgeable about the local market and have a successful track record in helping clients. Look for references and testimonials to confirm their experience. This step will ensure a seamless process during the house buying timeline.

The Home Search Process

Defining Your Ideal Home

During this phase, clearly define your ideal home characteristics, including the number of bedrooms and bathrooms, desired location, specific features (e.g., garage, backyard), and your budget range. This step is essential because it allows you to refine your search criteria, leading to more targeted results from real estate agents. Your ideal home should align with your lifestyle and needs, providing comfort and convenience for years to come. Consider the community you want to live in and identify the best location for your family’s needs. Also, consider any future needs or upgrades that you may require.

Exploring Properties

Start browsing properties within your budget and based on your criteria. Work with your real estate agent to schedule viewings and inspect properties that meet your expectations. Remember to compare properties with similar features in your neighborhood. You can also use online tools to identify trending properties or properties with similar characteristics. This exploration helps to reduce your options and focus on those that best meet your needs. It helps to have a checklist to assess the condition and potential issues of each property. Also, remember to ask your agent any questions you have.

Making an Offer

Once you’ve found a home, prepare a compelling offer that reflects the current market value. This typically includes factors like your purchase price, the required down payment, the mortgage terms, and any contingencies. Working closely with your real estate agent and perhaps a financial advisor, negotiate a fair offer to ensure that the deal is beneficial to both you and the seller. Always remember that this is a negotiation so you can leverage your best options to your advantage. Be prepared to potentially walk away from a deal if it doesn’t feel right

The Home Inspection and Financing Stages

Home Inspection and Appraisal

Conducting a comprehensive home inspection is crucial to identify potential issues with the property. This could be a simple crack in a wall or a major structural problem, so it is key that it is thorough and completed by a licensed home inspector. Get a professional opinion about the overall condition of the house and potential repairs. Be prepared to negotiate repairs, or decide if the home is worth continuing the purchase process based on the report. This stage will clarify any necessary repairs that may arise. An appraisal, conducted by a licensed appraiser, will determine the fair market value of the property, which is essential for the mortgage process.

Obtaining Financing

After the inspection is completed, you will need to finalize your mortgage financing. Coordinate with your lender to ensure all necessary documents are submitted and approved. Obtain a mortgage approval and complete all steps needed to guarantee the mortgage process. This includes gathering necessary financial documents and ensuring the property appraisal matches your required loan amount. This process can take several weeks, so make sure you have enough time allocated for this step.

Closing and Final Steps

Reviewing Loan Documents

Before closing, meticulously review all documents related to the mortgage loan. This includes the loan agreement, closing costs, and other relevant paperwork. You need to confirm everything is correct and understand all associated costs involved. Ensure you understand any additional fees or conditions related to the loan. Ensure that all the information is transparent and understandable.

Closing the Deal

Schedule the closing date with the appropriate professionals (real estate agent, lawyer, and lender). Make sure you have any required documents readily available for the closing process. It is also essential that you meet all deadlines to ensure a successful closing and finalize the process. The closing process officially transfers ownership of the property to you.

Moving In

Once the closing is complete, you can finally move into your new home! Celebrate the achievement of purchasing your new home. This is a special moment for homeownership.

Additional Considerations

Finding a Real Estate Attorney

Consult with a real estate attorney for legal advice and guidance throughout the purchase process. They can review contracts and provide insights to protect your interests. An attorney can provide support and guidance.

Managing Closing Costs

Understand the different closing costs involved, such as appraisal fees, title insurance, recording fees, and others. Thoroughly review and analyze all costs involved and ensure transparency.

Contingency Plans

Establish contingency plans for potential issues like financing delays or unexpected repairs to maintain a calm attitude. Anticipate problems and have a plan in place to ensure smooth sailing and a stress-free experience.

What should I do if there are issues discovered during the home inspection?

If problems are found during the home inspection, discuss them with your real estate agent, lender, and potentially your attorney. Work with the seller to address the identified issues or consider adjusting the offer price accordingly. Some problems might necessitate renegotiating the sale price or delaying the process. Transparency and clear communication are key in these situations to ensure a satisfactory resolution for both parties.

What is the importance of setting a budget?

Setting a detailed budget for your home purchase is critical to avoid overspending and making informed financial decisions. By creating a clear budget, you will have a specific timeline for your purchase. This also helps you plan for potential challenges and unexpected costs, making the home buying process smoother and less stressful.

In conclusion, the timeline of purchasing a new home is a complex process that requires careful planning and execution. By understanding each step, from initial research to final closing, you can navigate the process smoothly and avoid common pitfalls. Remember to prioritize your needs and budget and seek expert advice when needed. Ready to embark on your homeownership journey? Let’s get started!