Buying a new condo represents a significant step towards achieving homeownership, a goal often intertwined with financial security and a sense of stability. The allure of condo living, with its amenities and often lower maintenance compared to a single-family home, is undeniable. However, the process can be daunting, and it’s easy to get overwhelmed with the various steps and considerations involved. This comprehensive guide will walk you through buying a new condo, from initial research to final closing, providing actionable advice to help you navigate this crucial transition confidently. This article will delve into critical stages of the process, including researching the market, evaluating financial readiness, selecting the right unit, negotiating the purchase, and securing financing. We’ll also touch upon important considerations such as community fees and property management.

Researching the Market: Understanding Condo Trends

Market Analysis and Trends

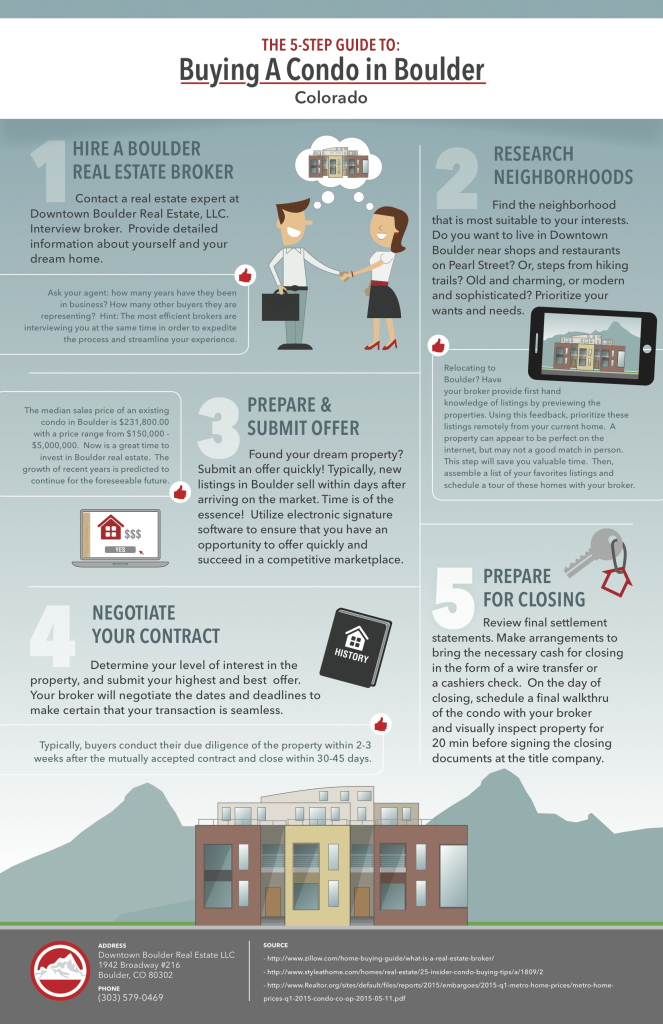

The first step in buying a new condo is thorough market research. Understanding current trends, pricing patterns, and overall market dynamics can significantly impact your decision-making. Studying sales data from similar properties, identifying emerging areas, and analyzing developer reputation are crucial parts of this process. Local news articles and real estate websites are fantastic resources for staying updated on market developments, and following reputable real estate bloggers can keep you informed about significant trends.

Identifying Emerging Areas

Analyzing emerging areas for new condo developments is important. These areas often showcase upcoming infrastructure improvements, planned amenities, and a higher potential for future appreciation. Identifying locations with increasing demand and good public transportation connectivity is also part of this process. Look into factors such as crime rates, proximity to schools, employment opportunities, and local amenities like parks or community centers.

Evaluating Financial Readiness

Understanding your financial situation and affordability is paramount. Consider all financial obligations and potential costs associated with the purchase, including the down payment, closing costs, potential maintenance fees, and homeowner’s insurance. A clear understanding of your budget and cash flow will empower you to make informed decisions and avoid potential financial strain. Consult a financial advisor to discuss options for financing and understand the implications of different loan terms.

Evaluating Financial Readiness: Planning Your Budget

Down Payment and Closing Costs

Determining the required down payment and closing costs is a critical part of your financial planning. A larger down payment can often translate to lower interest rates and a more favorable mortgage approval. Factor in all the closing costs associated with the purchase, such as title insurance, appraisal fees, and legal fees. Accurately estimating these expenses is key to maintaining a realistic budget.

Mortgage Pre-Approval and Financing Options

Securing a pre-approval for a mortgage is crucial in the buying process. With a pre-approval, you’ll know your maximum borrowing capacity, empowering you to effectively negotiate within your financial constraints. Explore various financing options, such as fixed-rate mortgages or adjustable-rate mortgages, to identify the best fit for your needs and financial situation. Consult a mortgage broker or lender to understand the different financing options available to you.

Budget Contingency

Setting aside a contingency fund to cover unexpected costs is essential. The condo buying process can involve unanticipated expenses, such as repairs or unforeseen issues during the home inspection. Maintaining a buffer for these potential expenses safeguards your financial stability during the process.

Selecting the Right Unit: Factors to Consider

Unit Features and Amenities

When browsing available units, consider the features and amenities that align with your needs and preferences. Look for factors such as the size of the unit, the number of bedrooms and bathrooms, and the layout. Pay close attention to details like the view, the presence of a balcony or terrace, and the quality of appliances and fixtures. Detailed reviews, online forums, and even visiting similar units can help make informed decisions.

Location and Community Aspects

Consider the location of the condo building and the surrounding community. Factors such as proximity to work, schools, shopping centers, and public transportation are essential considerations for most buyers. Reviewing local amenities, safety records, and community interaction can offer valuable insights for assessing the overall quality of life in the area.

Condo Amenities

Research and evaluate the available condo amenities. Features such as swimming pools, fitness centers, playgrounds, and meeting rooms can enhance the living experience and potentially increase property value. Consider how important these amenities are to you and your lifestyle.

Negotiating the Purchase: Key Strategies

Understanding the Offer Process

Understanding the offer process is critical to navigating the negotiation effectively. Reviewing the purchase agreement and understanding the various clauses, including contingencies, inspection periods, and financing conditions, is crucial. By understanding each stage of the process, you can present a strong and well-informed offer, significantly increasing the chance of getting it accepted.

Negotiating a Fair Price

Negotiating a fair price involves understanding the market value and the current offers in the area. Using reliable online tools and working with a real estate agent can provide insights that are valuable for creating the most favorable deal. Be clear about your budget and the aspects of the unit you’re looking for. Remember to document all your communications and decisions to ensure transparency throughout the negotiation.

Closing the Deal

Negotiating a strong closing agreement that addresses contingencies, inspection reports, and final approvals ensures a smooth transaction. By being mindful of the details in the closing agreement, you can avoid potential issues and protect your interests throughout the process.

Securing Financing: Options and Considerations

Mortgage Qualification

Before securing financing, understand the requirements for mortgage qualification. A comprehensive evaluation of credit scores, debt-to-income ratios, and other financial factors will impact your ability to get approved. Understand what financial records the lender may request.

Refinancing Options

Explore various refinancing options that may be available to you during the process. These options can provide better terms or conditions for the loan, lowering your monthly payments or saving you money over the long term. Consider the pros and cons of each option to make an informed decision.

Insurance Requirements

Understanding insurance requirements is a crucial step. Make sure you understand the need for homeowner’s insurance to cover potential damages or losses associated with the property. Review your options for coverage with different providers to ensure you are adequately protected.

In conclusion, purchasing a new condo is a significant step towards homeownership, one that requires careful planning and execution. By following the steps outlined in this guide, you’ll be well-positioned to navigate the process successfully, from initial research to final closing. Remember, due diligence is key to ensuring a smooth transition into condo living and securing a rewarding investment. For further assistance or personalized guidance, consider consulting a real estate agent specializing in condo purchases. Don’t hesitate to reach out for expert advice!