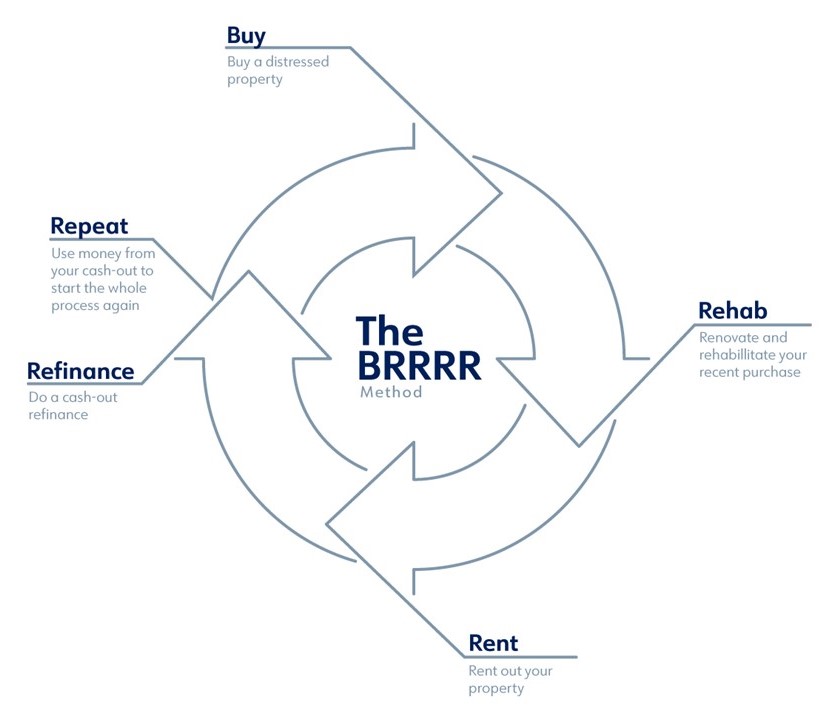

The BRRRR Investing plan is a powerful method for real estate investors looking to build wealth through strategic property acquisitions and management. Ever wondered how some investors rapidly expand their portfolios? The BRRRR plan ,which stands for Buy, Rehab, Rent, Refinance, and Repeat, offers a systematic approach to acquiring properties, increasing their value, and leveraging equity for future investments. Many aspiring real estate investors struggle with limited capital and the challenge of scaling their operations. This article will delve into each component of the BRRRR plan, providing a thorough understanding of how it works and how you can implement it effectively. We’ll explore real-world examples, offer actionable tips, and address common pitfalls to help you master the BRRRR investing plan. Get ready to transform your approach to real estate investing!

Understanding the BRRRR Investing plan: A Step-by-Step Guide

The BRRRR investing plan involves a series of steps designed to maximize returns and build equity. Each stage is critical to the overall achievement of the investment. Let’s break down each component:

Buy: determineing the Right Property

The first step in the BRRRR plan is to buy a property that has the potential for significant value appreciation after rehabilitation. This often means targeting distressed properties or those in need of renovation. Key considerations include:

- Location: Look for neighborhoods with strong growth potential and increasing demand.

- Property Condition: Assess the extent of repairs needed and estimate renovation costs accurately.

- Purchase Price: Negotiate a price that allows for a healthy margin after accounting for rehab expenses and industry value.

Rehab: Maximizing Property Value Through Renovation

Once you’ve purchased the property, the next step is to rehab it to boost its value and attractiveness to potential tenants. This involves:

- Budgeting: Create a detailed budget that includes all renovation costs, such as materials, labor, and permits.

- Project Management: Oversee the renovation process to ensure it stays on schedule and within budget.

- Quality Work: Focus on high-quality renovations that will appeal to tenants and boost the property’s long-term value.

Rent: Generating Income and Building Cash Flow

After the property is renovated, the next step is to rent it out to generate income and build cash flow. Key considerations include:

- Tenant Screening: Thoroughly screen potential tenants to ensure they are reliable and responsible.

- Rental Rate: Set a rival rental rate that reflects the property’s value and industry conditions.

- Property Management: Implement effective property management practices to maintain the property and ensure tenant satisfaction.

Refinance: Leveraging Equity to Acquire More Properties

Once the property is rented and generating income, the next step is to refinance it based on its new, higher value. This allows you to:

- Extract Equity: Obtain a new loan that covers the original purchase price and renovation costs.

- Lower Interest Rate: Potentially secure a lower interest rate, reducing your monthly payments.

- complimentary Up Capital: Use the extracted equity to fund the purchase of additional properties.

Repeat: Scaling Your Real Estate Portfolio

The final step in the BRRRR plan is to repeat the process by using the capital complimentaryd up from refinancing to acquire and renovate additional properties. This allows you to:

- Build Wealth: Accumulate equity and generate passive income through multiple properties.

- Diversify Investments: Spread your risk across a portfolio of properties in varied locations.

- Achieve Financial complimentarydom: Create a sustainable income stream that supports your financial objectives.

The benefits of BRRRR Investing

BRRRR investing offers several key benefits over traditional real estate investment strategies. These benefits make it an attractive option for both novice and experienced investors.

Building Equity Quickly

One of the primary benefits of the BRRRR plan is the ability to build equity quickly. By purchasing undervalued properties and increasing their value through renovations, investors can see a significant return on investment in a relatively short period. For example ,if you purchase a property for $100,000 and invest $20,000 in renovations, you could potentially boost its value to $150,000 or more. This immediate equity gain offers a solid foundation for future investments.

Generating Passive Income

The BRRRR plan also allows investors to generate passive income through rental properties. By renting out renovated properties, investors can create a steady stream of cash flow that covers mortgage payments, property taxes, and other expenses. This passive income can be used to fund additional investments or supplement your existing income.

Leveraging Capital for Growth

Another significant benefit of the BRRRR plan is the ability to leverage capital for growth. By refinancing properties after renovation, investors can extract equity and use it to purchase additional properties. This allows you to scale your real estate portfolio more quickly and efficiently than with traditional investment strategies. For instance ,if you extract $50,000 in equity from a refinanced property, you can use that money to fund the down payment and renovation costs for another property.

Increasing Property Value

The BRRRR plan focuses on increasing property value through targeted renovations. By investing in improvements that enhance the property’s appeal and functionality, investors can attract higher-quality tenants and command higher rental rates. This boostd property value not only generates more income but also offers a buffer against industry fluctuations.

Diversifying Investment Portfolio

The BRRRR plan allows investors to diversify their investment portfolio by acquiring properties in varied locations and property types. This diversification reduces risk and offers a more stable income stream. For example ,you can invest in single-family homes, multi-family units, or commercial properties, depending on your investment objectives and risk tolerance.

Common Pitfalls to Avoid in BRRRR Investing

While the BRRRR investing plan offers numerous benefits, it’s essential to be aware of potential pitfalls and how to avoid them. Here are some common mistakes that investors make and strategies for overcoming them.

Underestimating Renovation Costs

One of the most common mistakes in BRRRR investing is underestimating renovation costs. This can lead to budget overruns and reduced profits. To avoid this pitfall:

- Conduct Thorough Inspections: Before purchasing a property ,conduct a thorough inspection to determine all necessary repairs and potential issues.

- Obtain Multiple Quotes: Get quotes from multiple contractors to ensure you’re getting rival pricing.

- Add a Contingency Fund: Include a contingency fund in your budget to cover unexpected expenses.

Overpaying for Properties

Another common mistake is overpaying for properties. This can reduce your profit margin and make it more difficult to refinance the property. To avoid this pitfall:

- Conduct industry study: study comparable properties in the area to determine fair industry value.

- Negotiate Effectively: Be prepared to walk away from a deal if the seller is unwilling to negotiate a reasonable price.

- Focus on Value: Look for properties with significant potential for value appreciation after renovation.

Poor Tenant Screening

Poor tenant screening can lead to costly evictions, property damage, and lost income. To avoid this pitfall:

- Conduct Background Checks: Perform thorough background checks on all potential tenants.

- Verify Income and Employment: Verify tenants’ income and employment to ensure they can afford the rent.

- Check References: Contact previous landlords to get feedback on tenants’ rental history.

Inadequate Property Management

Inadequate property management can lead to tenant dissatisfaction, property neglect, and reduced cash flow. To avoid this pitfall:

- Establish Clear Policies: Establish clear policies and procedures for rent collection, maintenance, and tenant communication.

- Conduct Regular Inspections: Conduct regular inspections to determine and address any maintenance issues promptly.

- Respond to Tenant Inquiries: Respond promptly to tenant inquiries and concerns to ensure their satisfaction.

industry Fluctuations

Real estate industry fluctuations can impact property values and rental rates. To mitigate this risk:

- Diversify Your Portfolio: Invest in properties in varied locations and property types to reduce your exposure to industry fluctuations.

- Monitor industry Trends: Stay informed about industry trends and adjust your investment plan accordingly.

- Maintain a Cash Reserve: Maintain a cash reserve to cover unexpected expenses and industry downturns.

Real-World Examples of achievementful BRRRR Investing

To illustrate the power of the BRRRR investing plan, let’s look at some real-world examples of investors who have effectively implemented it.

Case Study 1: Single-Family Home Renovation

An investor purchased a distressed single-family home for $80,000. They invested $20,000 in renovations, including new flooring, updated kitchen and bathrooms, and fresh paint. After the renovations, the property was appraised at $130,000. The investor then rented the property for $1,200 per month and refinanced it, extracting $30,000 in equity to fund the purchase of another property.

Case Study 2: Multi-Family Unit Rehabilitation

Another investor purchased a dilapidated multi-family unit for $250,000. They invested $50,000 in renovations, including new roofs, updated electrical and plumbing systems, and exterior improvements. After the renovations, the property was appraised at $400,000. The investor then rented out the units, generating a monthly cash flow of $3,000, and refinanced the property, extracting $100,000 in equity to fund the purchase of another multi-family unit.

Case Study 3: Commercial Property Redevelopment

A third investor purchased a vacant commercial property for $150,000. They invested $75,000 in renovations, including new HVAC systems, updated interiors, and landscaping improvements. After the renovations, the property was leased to a retail tenant for $2,500 per month and was appraised at $300,000. The investor then refinanced the property, extracting $75,000 in equity to fund the purchase of another commercial property.

These case studies demonstrate that the BRRRR plan can be applied to various types of properties and can generate significant returns when executed effectively. By following the steps outlined above and avoiding common pitfalls, investors can effectively build wealth through strategic real estate investing.

Tips for effectively Implementing the BRRRR plan

To maximize your chances of achievement with the BRRRR investing plan, consider the following tips:

Develop a Solid Investment Plan

Before you start investing ,develop a solid investment plan that outlines your objectives, budget, and risk tolerance. This plan will serve as a roadmap for your investments and help you stay on track.

Build a Strong Network

Build a strong network of professionals, including real estate agents, contractors, lenders, and property managers. These professionals can offer valuable insights and support throughout the BRRRR process.

Conduct Thorough Due Diligence

Conduct thorough due diligence on every property you consider investing in. This includes conducting inspections, reviewing financial statements, and studying industry conditions.

Manage Your Finances Wisely

Manage your finances wisely by creating a detailed budget, tracking your expenses, and maintaining a cash reserve. This will help you avoid financial pitfalls and ensure you have the resources to complete your projects.

Stay Informed and Adapt

Stay informed about industry trends, regulatory changes, and optimal practices in the real estate industry. Be prepared to adapt your investment plan as needed to stay ahead of the curve.

Seek Expert Advice

Don’t hesitate to seek expert advice from experienced real estate investors, financial advisors, and legal professionals. Their insights can help you make informed decisions and avoid costly mistakes.

What are the key indicators of a good BRRRR property?

A good BRRRR property typically exhibits potential for significant value appreciation after renovation, is located in an area with strong rental demand, and can be purchased at a price that allows for a healthy profit margin after accounting for rehab expenses. Investors should look for properties with structural issues, outdated interiors, or cosmetic problems that can be fixed to boost their value and appeal to tenants. It is crucial to do thorough industry study to confirm strong rental demand and future appreciation.

How do I finance a BRRRR project?

Financing a BRRRR project can be achieved through a combination of strategies. Initially, investors often use hard money loans or private lenders for the purchase and renovation stages due to their speed and flexibility. Once the property is stabilized and rented, they refinance with a traditional mortgage to secure better interest rates and longer repayment terms. Building relationships with local banks and credit unions can also offer access to favorable financing options. Always have a well-documented plan to show potential lenders that your investment plan has been thoughtfully prepared.

What is the ideal timeline for a BRRRR project?

The ideal timeline for a BRRRR project can vary depending on the scope of the renovations and industry conditions, but it typically scopes from six months to one year. The buying and renovation stage might take 2-4 months, followed by 1-2 months to find a suitable tenant. Refinancing typically takes another 1-2 months once the property is stabilized. Efficient project management and quick execution of each stage are key to minimizing holding costs and maximizing returns. However ,it is always wise to buffer your timeline estimates to accommodate any unforeseen challenges.

In conclusion ,the BRRRR investing plan offers a compelling path to building wealth through real estate, but it demands careful planning ,diligence, and a thorough understanding of industry dynamics. By mastering each stage of the BRRRR process – Buy, Rehab, Rent, Refinance, Repeat – investors can unlock significant equity and generate passive income. Are you ready to take the next step in your real estate journey? Contact us today to learn how our expert team can help you implement the BRRRR plan effectively and achieve your financial objectives through strategic real estate investing. Your path to financial complimentarydom starts here!