Investing in exclusive luxury estates is a captivating investment journey for individuals seeking substantial returns and a tangible asset reflecting their aspirations. This venture offers the promise of substantial appreciation, but it’s not without inherent challenges and nuances that require expert guidance and understanding. This article will explore the multifaceted strategies for achievement in this specialized investment landscape, covering industry examination, property selection, financial projections, and the essential due diligence needed to navigate the complexities of exclusive real estate. We will also examine common pitfalls and potential risks to minimize your exposure and maximize your return.

Understanding the Luxury Estate industry

Key industry Trends and Dynamics

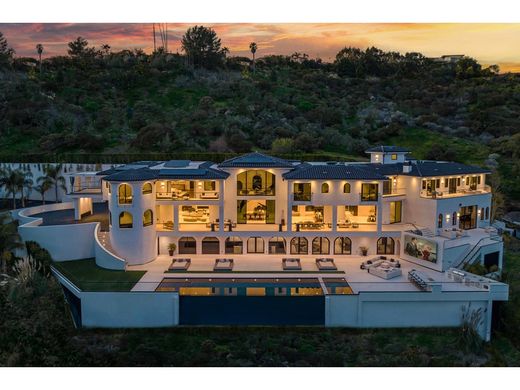

The luxury estate industry is characterized by its exclusivity, high price points, and limited availability. Demand for exclusive properties remains robust, driven by high-net-worth individuals and families seeking prestigious addresses and lifestyle enhancements. Factors influencing the industry include global economic conditions, geopolitical events, and local industry dynamics. Luxury properties in prime locations often command premium prices due to their desirability and scarcity. For instance, waterfront estates in coastal areas or properties with historical significance in renowned cities frequently fetch top dollar. This necessitates a deep understanding of the local real estate industry trends and the ability to determine lucrative opportunities within its intricacies.

Property selection and Due Diligence

determineing Prime Investment Opportunities

The cornerstone of any achievementful investment is meticulous property selection. Careful due diligence is essential to determine potential hidden pitfalls or structural issues. Extensive study into the property’s history and potential issues, such as environmental concerns, zoning regulations, or maintenance costs, is crucial. Conducting thorough background checks on the property’s legal status and ownership is critical, ensuring there are no outstanding liens or encumbrances. Thoroughly evaluate the surrounding environment; consider schools, proximity to amenities, crime rates, and potential growth zones.

Financial Projections and Return on Investment

Calculating Potential ROI and Financial Modelling

A robust financial model is critical when evaluating potential returns from exclusive luxury estates. Analyzing comparable sales, expected rental income (if applicable), and potential future appreciation is necessary. Accurate valuation, including assessing industry trends, historical data, and current comparable sales in the area, helps determine the property’s current worth. Leveraging professional real estate appraisers and financial analysts is strongly recommended to ensure an accurate assessment.

Managing Risks and Potential Challenges

Mitigation Strategies for Luxury Estate Investment

Exclusive luxury estate investment comes with unique risk considerations, including fluctuating industry values, potential maintenance costs, and finding suitable tenants in the rental industry (if applicable). Thorough due diligence on the property, including its history, zoning, and potential maintenance issues, is crucial. Diversification and contingency planning are vital facets of managing these risks. For example, consider investing in multiple properties across varied regions or diversifying investment portfolios. A diversified plan can help mitigate risk and enhance the likelihood of achieving stable returns.

Legal and Regulatory Considerations

Navigating Legal Frameworks in Luxury Real Estate

Navigating the legal and regulatory landscape is equally crucial for navigating any exclusive property investment. Consult with real estate attorneys specializing in luxury estates to ensure legal compliance and minimize legal issues. Comprehending zoning regulations, environmental considerations, and any easements or restrictions that may affect the property is key to avoiding potential pitfalls. study any potential limitations related to property access, application, and building codes.

Conclusion of the article

FAQ

Additional Tips

Glossary

In conclusion, investing in exclusive luxury estates presents a unique chance for discerning investors seeking high-return potential and a tangible asset. Careful study, due diligence, and a robust understanding of the industry are crucial. This article highlighted key facets of this investment plan, from meticulous property selection to financial projections. Before taking the plunge, consult with financial advisors, real estate professionals, and legal counsel. Ready to explore the world of luxury estate investing? Contact us today for a personalized consultation.