Affordable homes: making homeownership accessible is the cornerstone of sustainable communities and individual well-being. For many, owning a home represents stability, a sense of belonging, and a chance to build equity. However, the current housing market often presents significant challenges, making homeownership seem out of reach for many. This article will explore actionable strategies and resources to demystify the complexities of affordable housing, guiding readers through the practical steps needed to achieve homeownership.

Understanding the Barriers to Affordable Homeownership

Economic Hardships

The rising costs of housing, coupled with stagnant wages, make homeownership a significant financial hurdle for many. Limited income often makes even the most basic down payment requirements unattainable. Furthermore, the rising cost of essentials further adds to the strain.

Complex Financing Options

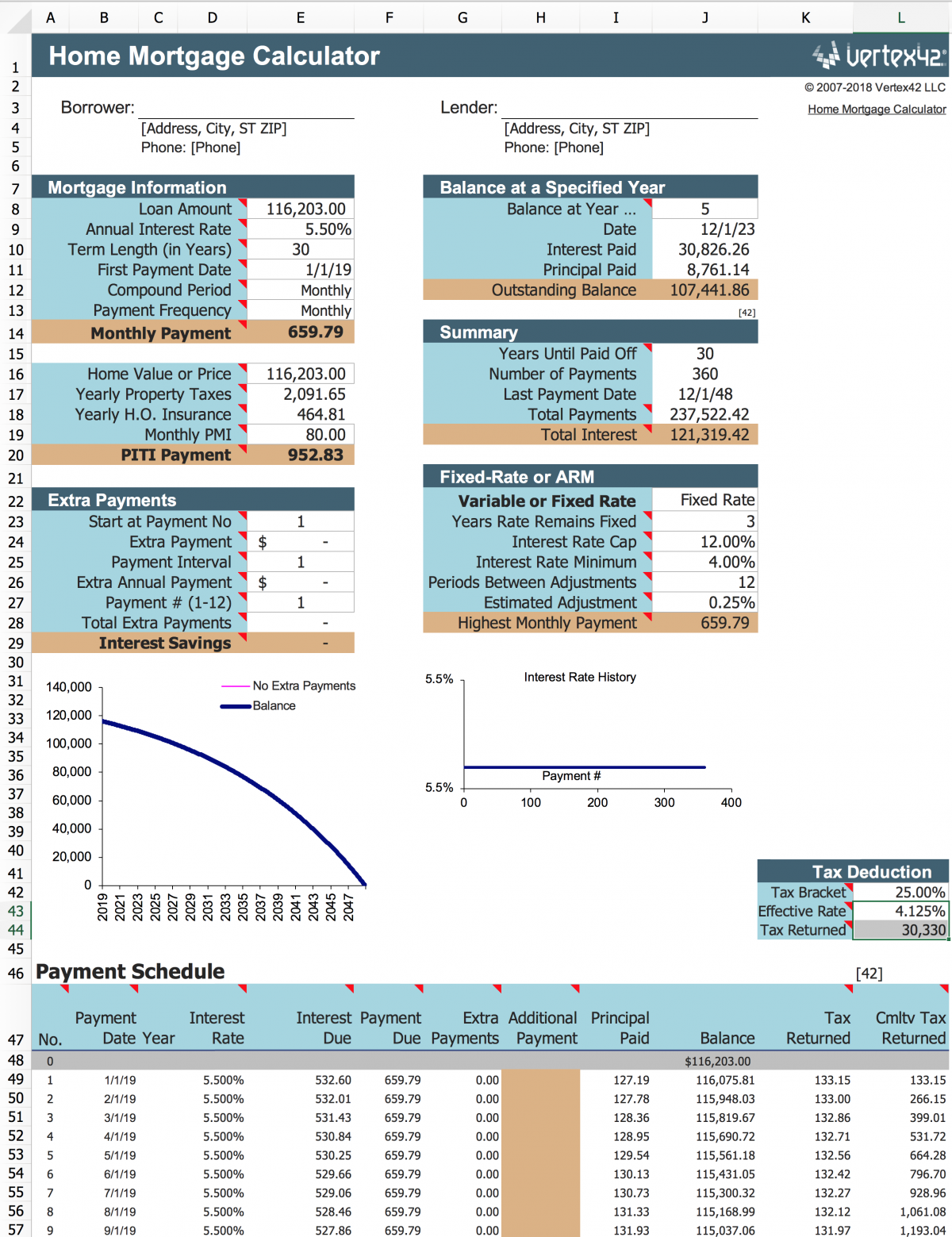

Navigating the complexities of mortgage financing can be overwhelming. Different loan programs, interest rates, and qualification criteria can make the process confusing. The jargon and nuances of the loan application process often put off potential homeowners.

Market Fluctuations

Real estate markets experience fluctuations, making purchasing decisions challenging. The variability and volatility of the market conditions makes it hard to predict trends in prices, further adding to uncertainty and concern.

Limited Access to Support Programs

Often, qualified support programs for first-time homebuyers are not widely publicized, leading to limited awareness. Potential homebuyers might not be aware of the resources and options available to them. Lack of awareness and access to information adds to the overall difficulty.

Exploring Financing Options for Affordable Homes

Government Assistance Programs

Many governments offer programs to assist first-time homebuyers and low-to-moderate-income families. These programs can provide down payment assistance, lower interest rates, and other financial incentives. Specific programs vary by location and eligibility requirements. It’s crucial to research relevant programs in your region to explore available resources.

Innovative Financing Models

Innovative financing models, such as shared equity programs and community land trusts, can address the challenges of affordability by creating more options for financing. These programs often lower barriers to entry and make homeownership more accessible.

Subsidized Loans

Subsidized loans often provide favorable interest rates, potentially lowering the monthly mortgage payments. These options often come with specific terms and conditions that prospective buyers should carefully review. Transparency and careful evaluation are paramount in this area.

Analyzing the Local Housing Market

Market Research and Trends

Staying informed about local market trends, including housing prices, inventory levels, and interest rates is critical to making informed decisions. Data-driven insights into the local market dynamics can help determine the best time to purchase and navigate the various options effectively.

Housing Stock Availability

Understanding the available housing stock in specific locations is crucial. Exploring different neighborhoods, considering the potential need for renovations or updates, and researching local building regulations can assist in strategic planning and decision making.

Finding the Right Fit

Identifying the ideal home that aligns with your financial capacity, lifestyle, and preferences is essential. Careful consideration of factors, including location, size, and amenities, can significantly influence the process. Understanding your individual needs helps you narrow down your options effectively.

Leveraging Technology for Enhanced Accessibility

Online Resources for Homebuyers

Utilizing online resources and tools for market analysis, financing calculations, and home search platforms can help streamline the process. Using technology to gather information efficiently can reduce stress and improve the home-buying experience.

Virtual Tours and Online Communities

Embracing virtual tours and engaging with online communities of homeowners and real estate professionals can provide valuable insights. Virtual tools often offer wider access to information and potential opportunities compared to traditional means.

Embracing Innovative Solutions for Affordable Homeownership

Co-housing Communities

Co-housing communities represent an innovative solution, allowing individuals to share housing costs and resources. These communities often offer a supportive environment and cost-effective living options.

Rent-to-Own Programs

Rent-to-own programs offer an intermediate step toward homeownership, allowing individuals to gradually build equity and move towards owning their homes over time. This phased approach can make homeownership more approachable.

Community Land Trusts

Community land trusts provide long-term affordable housing options. These models work to ensure affordable homes remain available for communities by restricting the sale price of homes.

In conclusion, achieving affordable homeownership is a multifaceted endeavor that requires a combined approach. By exploring diverse financing options, understanding local market dynamics, and embracing innovative solutions like co-housing, aspiring homeowners can significantly increase their chances of securing their dream homes. This article has provided insights into various strategies and practical steps. Remember to do your research, consult with financial advisors, and consider government support programs for further guidance. This journey of making homeownership accessible is achievable, and with dedication and planning, it can become a reality for many.