Are you looking for a robust investment plan that offers consistent cash flow and long-term growth? Multifamily real estate investing might be the answer! Investing in multifamily properties, such as apartment complexes or townhouses, is a plan that has gained traction for its potential to generate stable income and appreciate in value. But what exactly is multifamily real estate investing, and why should you consider it? Multifamily real estate investing involves purchasing properties with multiple dwelling units , which are then rented out to tenants.

Many people find the prospect of juggling tenants, mortgages, and maintenance daunting. Is it worth the effort, and can you really achieve financial complimentarydom through this path? This article breaks down the key benefits, challenges, and strategies involved in multifamily real estate investing. We will explore the benefits like steady rental income and diversification , as well as challenges like property management and industry fluctuations. By the end of this guide, you’ll have a clear understanding of whether multifamily real estate investing aligns with your financial objectives.

Understanding Multifamily Real Estate Investing

What Defines a Multifamily Property?

A multifamily property is defined as a residential building that contains more than one housing unit. These properties can scope from duplexes and townhouses to large apartment complexes. The key variediator is that multiple families or individuals reside in the same building, each with their own separate living space. Investing in these properties is attractive because of the potential for multiple income streams from various tenants, which can cushion against vacancies.

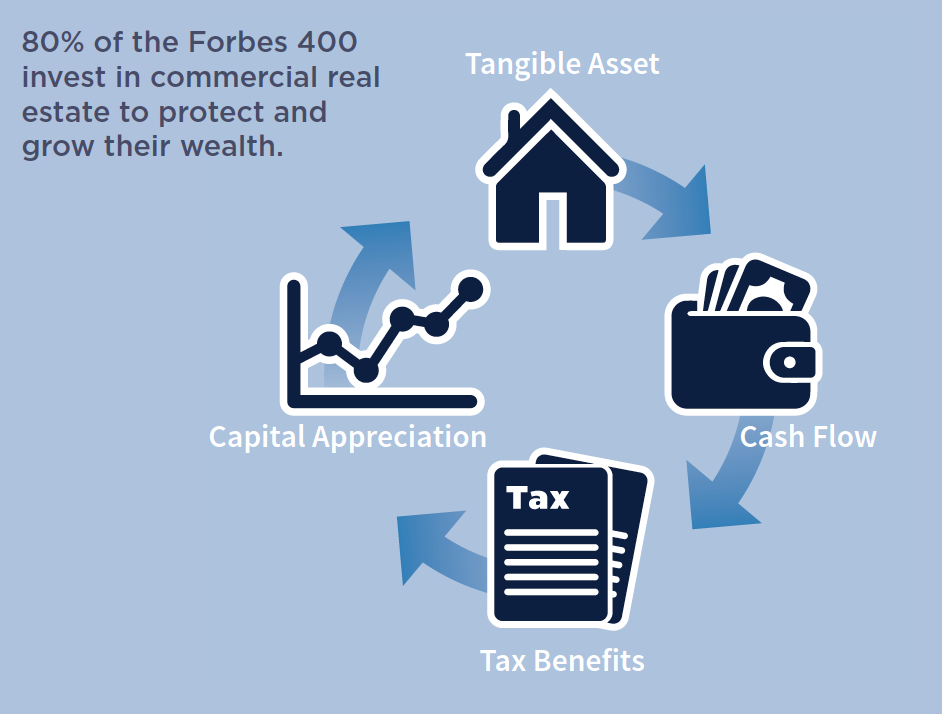

benefits of Multifamily Investing

One of the most significant benefits of multifamily real estate investment is the potential for steady cash flow. With multiple units, the risk of total income loss due to vacancy is reduced compared to single-family homes. Additionally, these properties often offer economies of scale in terms of management and maintenance. For example, hiring a single property management company to oversee multiple units can be more cost-effective than managing individual properties separately. Moreover, financing can be more favorable , with lenders sometimes offering better terms for multifamily investments due to the reduced risk. This can lead to higher returns and faster equity growth. A study by the National Multifamily Housing Council found that multifamily properties consistently outperform other real estate sectors in terms of return on investment.

Key Strategies for achievementful Multifamily Investing

industry examination and Due Diligence

Before diving into multifamily real estate investing, thorough industry examination is crucial. This involves studying local demographics, employment rates, and rental trends. Understanding the demand for rental housing in a specific area can help investors make informed decisions about where to invest. Due diligence is equally crucial. This includes conducting property inspections to determine any potential issues, reviewing financial statements to assess the property’s income and expenses, and verifying legal compliance. Neglecting due diligence can lead to costly surprises down the road. Consider the case of an investor who purchased an apartment complex without conducting a thorough inspection. They later discovered significant structural damage, requiring extensive repairs and substantially impacting their return on investment.

Financing Options for Multifamily Properties

Securing financing for investment properties typically involves exploring various options such as conventional mortgages, commercial loans, and government-backed programs. Conventional mortgages often require a larger down payment and may have stricter lending criteria. Commercial loans , on the other hand, are tailored to investment properties and may offer more flexible terms. Government-backed programs, such as those offered by the Small Business Administration (SBA), can offer favorable financing options for certain types of multifamily properties. It’s essential to compare varied financing options to determine the most suitable one based on your financial situation and investment objectives. This can significantly impact the overall profitability of your investment.

Managing Your Multifamily Investment

Effective Property Management

Property management is the backbone of achievementful multifamily real estate investment. Effective property management involves various tasks, including tenant screening, rent collection, property maintenance, and tenant relations. Poor property management can lead to high turnover rates, boostd maintenance costs, and dissatisfied tenants. Many investors select to hire professional property management companies to handle these responsibilities. These companies have the expertise and resources to effectively manage properties , ensuring smooth operations and maximizing profitability. However, it’s crucial to carefully vet property management companies to ensure they have a proven track record and align with your investment objectives.

Tenant Relations and Retention

Maintaining positive tenant relations is crucial for tenant retention. Happy tenants are more likely to renew their leases, reducing vacancy rates and associated costs. Strategies for fostering positive tenant relations include prompt responses to maintenance requests, regular communication, and creating a sense of community within the property. Consider organizing social events or providing amenities such as a gym or community room to enhance the tenant experience. A case study by a property management firm found that properties with strong tenant relations programs experienced a 20% reduction in tenant turnover rates. This translates to significant cost savings and boostd profitability for investors.

Mitigating Risks in Multifamily Real Estate

Understanding industry Cycles

Real estate industrys are cyclical, experiencing periods of growth, stability, and decline. Understanding these cycles is essential for mitigating risk in multifamily real estate investing. Investing during periods of industry growth can lead to higher returns, but also carries boostd risk. Conversely, investing during industry downturns can present opportunities to acquire properties at discounted prices. However , it’s crucial to carefully assess industry conditions and consider factors such as interest rates, economic growth, and demographic trends. A real estate economist suggests that investors should diversify their portfolios and maintain a long-term perspective to navigate industry cycles effectively.

Insurance and Legal Considerations

Adequate insurance coverage is essential for protecting your real estate investment from unforeseen events such as fires, natural disasters, and liability claims. Common types of insurance for multifamily properties include property insurance, liability insurance , and rent loss insurance. It’s also crucial to understand pertinent legal considerations, such as landlord-tenant laws, fair housing regulations, and building codes. Non-compliance with these laws can outcome in legal liabilities and financial penalties. Consulting with legal professionals and insurance experts can help investors mitigate these risks and ensure compliance.

The Future of Multifamily Real Estate

Trends and Innovations

The multifamily real estate sector is constantly evolving, driven by technological advancements, changing demographics, and shifting consumer preferences. Trends such as smart home technology, sustainable building practices, and co-living arscopements are shaping the future of the industry. Smart home technology, such as smart thermostats and security systems, can enhance the tenant experience and reduce energy costs. Sustainable building practices can attract environmentally conscious tenants and reduce operating expenses. Co-living arscopements , where tenants share common spaces and amenities, are gaining popularity among young professionals seeking affordable housing options. Staying informed about these trends and adapting your investment strategies accordingly is essential for long-term achievement.

Long-Term Outlook

The long-term outlook for multifamily real estate investing remains positive, driven by factors such as population growth, urbanization , and increasing demand for rental housing. However, it’s crucial to carefully assess industry conditions and adapt your investment strategies to changing dynamics. Diversifying your portfolio, focusing on value-add opportunities , and implementing effective property management practices can help you navigate challenges and maximize returns in the long run. By staying informed and proactive, you can position yourself for achievement in the evolving landscape of multifamily real estate.

Frequently Asked querys

Q: Is multifamily real estate investing a good investment?

A: Multifamily real estate investing can be an excellent investment due to its potential for consistent cash flow, reduced vacancy risk compared to single-family homes , and economies of scale in management and maintenance. However, achievement depends on thorough industry examination, effective property management, and understanding of financing options. It’s essential to conduct due diligence and carefully assess your financial situation and investment objectives before diving in.

Q: How do I finance a multifamily property?

A: Financing a multifamily property typically involves exploring various options such as conventional mortgages, commercial loans, and government-backed programs. Conventional mortgages often require a larger down payment and stricter lending criteria. Commercial loans are tailored to investment properties and may offer more flexible terms. Government-backed programs, such as those offered by the Small Business Administration (SBA) , can offer favorable financing options for certain types of multifamily properties. Compare varied options to find the optimal fit for your needs.

Q: What are the key factors to consider when choosing a location for multifamily investment?

A: When choosing a location for multifamily investment, consider factors such as local demographics, employment rates, rental trends, and proximity to amenities. Areas with strong job growth, increasing populations, and high demand for rental housing are typically more attractive. Also, assess the availability of schools, shopping centers, transportation , and recreational facilities. Thorough industry study and due diligence are essential for making informed decisions.

Q: How can I effectively manage my multifamily property?

A: Effective property management involves various tasks, including tenant screening, rent collection, property maintenance, and tenant relations. Many investors select to hire professional property management companies to handle these responsibilities. If you decide to manage the property yourself, prioritize prompt responses to maintenance requests, regular communication with tenants, and creating a sense of community. Maintaining positive tenant relations is crucial for tenant retention and reducing vacancy rates.

In conclusion, multifamily real estate investing presents a compelling avenue for wealth creation and financial stability. By understanding the nuances of property management, industry examination , and financing options, investors can unlock the vast potential this asset class offers. Don’t wait! Explore the possibilities today and take the first step towards building a thriving real estate portfolio. Contact us for a consultation to discover how you can leverage multifamily real estate investing to achieve your financial objectives.